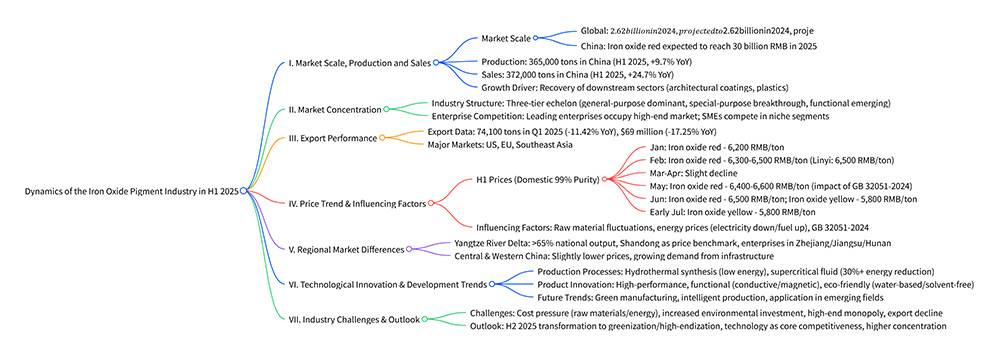

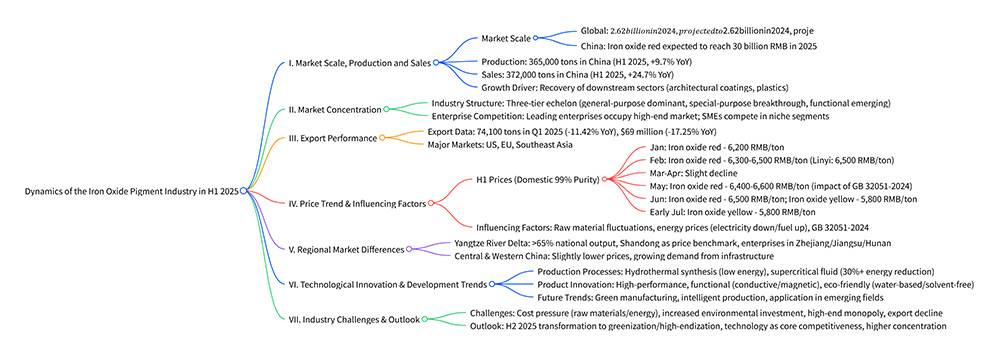

The iron oxide pigment industry in China performed impressively in the first half of 2025, with production reaching 365,000 tons (a year-on-year increase of 9.7%) and sales volume hitting 372,000 tons (a year-on-year increase of 24.7%), driven by the recovery of downstream industries such as architectural coatings. The global iron oxide market scaled $2.62 billion in 2024 (projected to reach $3.95 billion by 2032). As the world’s largest iron oxide producer, China’s iron oxide red market is expected to reach approximately 30 billion RMB in 2025, with the industry showing a three-tier structure of "general-purpose pigments dominating, special-purpose pigments making breakthroughs, and functional pigments emerging". In terms of prices, the average market price of domestic 99% iron oxide red was 6,200 RMB/ton in January, rose to 6,300-6,500 RMB/ton in February, declined slightly in March-April, rebounded to 6,400-6,600 RMB/ton in May due to the implementation of the GB 32051-2024 standard, and stabilized at 6,500 RMB/ton in June (with domestic 99% iron oxide yellow maintaining 5,800 RMB/ton during the same period). Export faced headwinds: in the first quarter of 2025, the cumulative export volume was 74,100 tons (a year-on-year decrease of 11.42%), and the export value was $69 million (a year-on-year decrease of 17.25%), with major markets in the US, EU, and Southeast Asia. Technologically, hydrothermal synthesis and supercritical fluid technology are driving process innovation, and products are developing towards high performance, functionality, and environmental friendliness. The industry is confronted with challenges such as rising raw material/energy costs, increased environmental protection investment, and foreign monopoly in the high-end market. It is expected that in the second half of 2025, driven by the in-depth implementation of the "dual carbon" policy and the recovery of downstream demand, the industry will accelerate its transformation towards greenization and high-endization, with further improved concentration.

- Global Market: The global iron oxide market reached $2.62 billion in 2024, maintaining a steady growth trend, and is expected to expand further to $3.95 billion by 2032.

- Chinese Market: As the world’s largest iron oxide producer, China performs prominently in the iron oxide red segment. Its iron oxide red market scale is projected to reach approximately 30 billion RMB in 2025.

- Production: In the first half of 2025, China’s iron oxide pigment production stood at 365,000 tons, a 9.7% year-on-year increase, with stable capacity release.

- Sales: During the same period, the market sales volume reached 372,000 tons, a 24.7% year-on-year increase. The growth rate of sales significantly outpaced that of production, indicating strong market demand.

- Growth Driver: The growth is mainly driven by the recovery of downstream industries such as architectural coatings and plastic products; the rebound in downstream demand directly boosts the production and sales of iron oxide pigments.

China’s iron oxide pigment industry currently presents a three-tier echelon structure: "general-purpose pigments dominating, special-purpose pigments making breakthroughs, and functional pigments emerging".

- General-purpose pigments occupy the mainstream market due to low technical barriers and a wide application scope.

- Special-purpose pigments have achieved technological breakthroughs in high-end application scenarios (e.g., automotive coatings).

- Functional pigments (e.g., conductive pigments, magnetic pigments) are in the R&D and emerging stage, with great future potential.

- Leading enterprises in the industry occupy a dominant position in the high-end market, relying on long-term technological accumulation and scale advantages.

- Small and medium-sized enterprises (SMEs) focus on niche segments (e.g., specific color systems, small-scale application scenarios) and gain market share through differentiated competition to avoid confrontation with leading enterprises.

In the first quarter of 2025, China’s iron oxide pigment exports encountered obstacles:

- Cumulative export volume: 74,100 tons, a 11.42% year-on-year decrease.

- Export value: $69 million, a 17.25% year-on-year decrease.

Both export volume and value declined.

China’s iron oxide pigment exports are mainly concentrated in the US, EU, and Southeast Asia —regions that are also major consumer markets for the global coatings and plastics industries. The export decline may be affected by factors such as fluctuations in local market demand and changes in trade policies.

The following table shows the monthly price changes in detail:

- Raw Material Cost Fluctuations: Long-term high raw material prices directly increase the production cost of iron oxide pigments, continuously squeezing enterprises’ profit margins.

- Energy Price Changes: Electricity prices showed an overall downward trend, while fuel prices fluctuated significantly, presenting a "roller-coaster" trend in the first half of the year. In June, oil prices rose twice in a row, with gasoline and diesel prices increasing by a total of 325 RMB/ton. The rise in fuel costs partially offset the benefit of lower electricity prices.

- Environmental Policies and New Energy Consumption Regulations: The Energy Consumption Quota for Titanium Dioxide and Iron Oxide Pigment per Unit Product ( GB 32051-2024 ), officially implemented on May 1, 2025, has a profound impact on the industry. Enterprises need to upgrade equipment and optimize processes to meet energy consumption requirements, which indirectly pushes up production costs.

- Core Advantages: Relying on a mature chemical industry chain and industrial agglomeration effect, the Yangtze River Delta contributes over 65% of China’s total iron oxide pigment production, with a high degree of industrial concentration.

- Price Benchmark: Shandong Province, as a major national production base, has a benchmarking role in iron oxide pigment quotations, directly influencing the price trend of the national market.

- Enterprise Distribution: Major production enterprises are concentrated in provinces such as Zhejiang, Jiangsu, and Hunan, forming a benign competitive pattern in the region and facilitating technological exchange and resource sharing.

- Price Difference: Affected by factors such as logistics costs and the maturity of the industrial chain, iron oxide pigment prices in central and western China are usually slightly lower than those in the Yangtze River Delta.

- Market Potential: With the continuous advancement of infrastructure construction (e.g., roads, buildings) in central and western China, local demand for iron oxide pigments is gradually increasing, promising great future growth space.

- Hydrothermal Synthesis: Low-energy-consumption technology is gradually replacing traditional production processes. It not only reduces energy consumption but also accurately controls product properties such as particle size and color, improving the stability of product quality.

- Supercritical Fluid Technology: As an innovative process, it can reduce production energy consumption by more than 30% and features stronger environmental friendliness, conforming to the industry’s green development needs.

- High-Performance Iron Oxide Pigments: Focus on improving key indicators such as weather resistance and dispersibility to meet the application needs of high-end coatings (e.g., outdoor architectural coatings, original automotive coatings).

- Functional Products: Develop special-purpose products such as conductive pigments and magnetic pigments to expand applications in fields like electronic components and new energy equipment.

- Eco-Friendly Products: Water-based and solvent-free iron oxide pigments have become R&D priorities, reducing VOC emissions during production and application to align with environmental policy requirements.

- Green Manufacturing: Promote full-life-cycle environmentally friendly production processes, achieving full-chain low-carbon environmental protection from raw material procurement and production processing to waste disposal.

- Intelligent Production: Introduce digital and automated technologies (e.g., intelligent control systems, robotic inspection) to improve production efficiency and product quality stability, while reducing labor costs.

- Application Expansion: Explore innovative applications of iron oxide pigments in emerging fields such as new energy (e.g., lithium battery cathode material additives) and electronics (e.g., chip packaging materials) to open up new growth space for the industry.

- Cost Pressure: High and fluctuating raw material prices, coupled with rising electricity and fuel costs, double-squeeze enterprises’ profit margins, putting particular operational pressure on SMEs.

- Environmental Constraints: To meet increasingly strict environmental requirements (e.g., VOC emission limits, solid waste disposal standards), enterprises need to continuously increase investment in environmental protection facilities and operating costs, facing significant financial pressure.

- International Competition: The high-end iron oxide pigment market is still monopolized by foreign enterprises, and domestic enterprises lag behind in core technologies and product added value. Meanwhile, the decline in exports in the first half of 2025 requires active exploration of emerging markets to ease external pressure.

In the second half of 2025, with the in-depth implementation of the "dual carbon" policy and further recovery of demand in downstream industries such as construction and plastics, China’s iron oxide pigment industry will accelerate its transformation towards greenization and high-endization. Technological innovation will become the core competitiveness of enterprises. Leading enterprises with technological advantages and scale effects will further seize market share, and the industry concentration is expected to continue to improve.

For more information about Shenhong Pigment's iron oxide pigments and cooperation opportunities, please contact us via the following channels:

- Head Office Address: No. 1 of Lane 185, South Anxie Road, Jiading District, Shanghai, China